Issuer Processor vs Merchant Acquirer | Meanings & Examples

There are a number of different players in the payments ecosystem each working together to ensure a swift and friction-free transactional experience, both on the issuing and acquiring side. In this article, we look at the role merchant acquirers and issuer processors play in the financial chain, and what makes them different.

What is the definition of an issuer processor?

As outlined here, an issuer processor is an extremely important part of the payment processing journey.

In the simplest terms, an issuer processor connects issuers and issuing banks directly with the card networks, such as Visa, MasterCard, or American Express. By doing this, issuer processors manage the issuance of cards, authorise transactions, communicate with the settlement entities, and provide a system of record.

Is it the same as an issuing bank?

In the payment process, an issuing processor is not the same as an issuing bank. An issuing bank, also known simply as an issuer, is a bank or financial institution that offers payment cards to consumers on behalf of card networks.

The issuing processor helps to facilitate this relationship, connecting the issuing bank with the acquiring bank and merchant account of the transaction process and making the transaction happen.

When you make a payment with a card, the funds are transferred from the issuing bank to the acquiring bank.

Examples of issuer processors

The growing interest in modern financial products has meant there’s a wealth of opportunity for issuer processors to enable the biggest fintech and non-bank programs globally. Examples of issuer processors include: Carta Worldwide, Global Processing Services, Tribe Payments, Marqeta, or Paymentology.

What is the definition of a merchant acquirer?

The merchant acquirer is the financial institution that maintains a merchant’s account in order to accept cards. The acquirer settles card transactions for a merchant into their account. Sometimes the acquiring payment processor and the acquirers are one and the same.

They essentially collect the details from payment card transactions that have been accepted by retailers. They then aggregate and separate those payments, sending them to card issuers, normally via the respective credit card networks, known as ‘interchange’.

Is it the same as an acquiring bank?

The terms merchant acquirer and acquiring bank are typically used interchangeably. An acquiring bank (sometimes referred to as an acquirer or credit card bank) is an institution that has the card schemes authorization to process a transaction and accept payments.

So, by signing a contract with the acquirer, a merchant can process credit and debit card transactions.

Examples of merchant acquirers

The merchant acquirer acts as a kind of ‘middle-man’, as they take the details of the transaction provided by the merchant and run these through the card scheme and onto the card issuer, enabling the transaction to be processed. It’s a growing market with so many new and innovative opportunities for selling in the merchant space.

Commonly known merchant acquirers you may have heard of, include GoCardless, Adyen, First Data, or WorldPay. Some of these merchant acquirers may also play the role of the payment service provider.

Where are the issuer processors and merchant acquirers in the whole payment process?

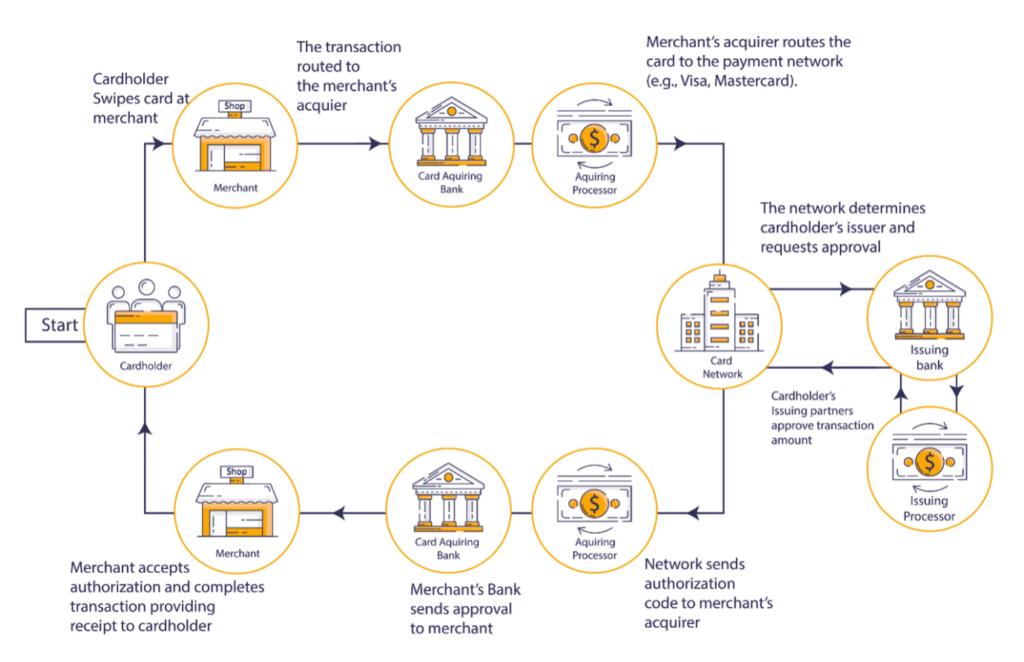

To highlight the differences between the two entities, it’s beneficial to take a look at the entire process of a card payment.

Payment processing services include authorisation, funding, and settling of a transaction. When a customer makes a purchase, the card payment is made at the point of sale. Although the card payments themselves take seconds, the process behind them is fairly complex.

The merchant sends a request to their payment processor for the authorisation of the transaction, then the payment processor carries out the following steps:

- The payment processor submits the transaction to the card network connected to the issuing bank and the connected issuer processor.

- The issuer processor either accepts or rejects the transaction based on certain criteria.

- The issuing bank then sends either an approval or rejection status back to the merchant’s bank, and finally to the merchant.

Following that process of authorisation is the process of settling and funding. This is the moment when the transaction is deposited into the merchant account. The merchants send the authorisation request to the payment processor, which then sends the details to the card network.

The card network is connected with the issuing processor therefore, the issuing processor receives the details of the transactions to further carry out the process which includes:

- The issuer processor charges a sum from the cardholders for the transaction.

- The issuing processor then transfers the relevant amount to the merchant bank minus the interchange fee.

- The merchant bank transfers the amount to the merchant’s account.

The issuer processor (the payment processor in the first bullet list) serves as a facilitator on behalf of the acquirers, forwarding the transaction information from the payment gateway to the card network.

The merchant acquirer (who contributes to the process in the second bullet list) receives the batched transactions at the end of the day and deposits that amount into the merchant account equal to the total of the batch minus applicable fees.

What are the main differences between issuer processors and merchant acquirers?

The main difference between issuer processors and merchant acquirers is the position they sit at within the transaction process. The issuer processor is connected to the issuing bank, facilitating the process of payments in, whilst the merchant acquirer helps send these funds to the acquiring bank.

If you’d like to understand more about the card-issuing ecosystem, we’ve written a handy article to help you learn about each of the key players.

To keep up to date with Carta Worldwide, check out our other articles in our resources area, or follow us on LinkedIn.

Fresh insights,

straight to your inbox

Sign up to the Carta Worldwide newsletter

to get the latest insights and news