Who are the different players in the card issuing ecosystem?

Card issuing is surprisingly one of the most interesting areas of the payments ecosystem as it is often at the heart of innovation and originality – and there is still enormous potential for growth with cashless uptake projected to rapidly increase all the way until 2030.

If you are thinking of launching and managing a new card programme, it is essential to understand the market and the key players involved in bringing your product to life.

In this blog, we will explain who they are and the role they play.

What is Payment Card Issuing?

Payment card issuing is building a custom-made card programme that fits the needs of your customers. These may include virtual or physical cards in the form of credit, debit, or prepaid cards for gifting, travel, and loyalty – just to name a few!

Typically, these cards are linked to an account; these accounts may be deposit, or loan/credit accounts and the card is a means of authenticating the cardholder.

The value of card issuing

Card issuing is crucial to the global payment’s ecosystem.

It is expected that 52% of all global point of sale (POS) payments are made using either a credit or debit card, with eWallets ranking only at 28%. This means that despite new payment methods being introduced, cards still play a dominant role in today’s consumer payment experience, and we don’t see that changing any time soon.

What is the difference between traditional and modern card issuing?

Traditional card issuing involves an issuing bank, a card network, and the cardholder.

Previously, traditional banks delivered card payments services on a ‘license to operate’ basis, which means they typically issue products such as debit, credit, and prepaid cards. They didn’t show much interest in exploring how they could be used as differentiators and be adapted for specific product verticals.

However, modern card issuance allows for delivering an immediate, digital-first payment experience. It has unlocked opportunities for more exciting features and benefits for cardholders. Programmes can be tailored to specific use cases and markets including rewards, cryptocurrency payments, and adaptable credit lines.

Fintech disruptors want more than what a single traditional bank-based partnership can offer, and are instead, opting to benefit from working with a variety of specialist partners to make their product a reality.

Who is part of the ecosystem?

There are several industry players required to create best-in-market products, so let’s dive into them.

KYC/KYB Provider

KYC (Know Your Customer) and KYB (Know Your Business) refer to the obligation of regulated entities, such as financial service providers, to identify their customers and assess their associated risks for money laundering on an ongoing basis.

Working with a specialist provider helps fintechs to meet their KYC/KYB legal requirements and ensure they are only providing payment products to legitimate customers that fit their onboarding criteria.

KYC/KYB providers use software to learn more about users and verify their details against reliable sources. For B2C products, the software will help you understand your customers’ ID in the form of their name, gender, nationality, occupation, and address. For B2B products, it will identify details such as their company name, registered address, and business license.

It’s important to know that many companies have been hit with fines for not complying with KYC/KYB regulations, which shows just how costly and seriously non-compliance should be taken.

Businesses need to follow strict rules to verify the identities and activities of their potential customers, and if suspicious behaviour is discovered, you and your provider have a responsibility to report it to the authorities.

Issuer Payment Processor

An issuer payment processor is a technology company that processes payments. It handles the transaction process to approve or decline payments using various card types such as credit cards, debit cards, and prepaid cards.

An issuer processor operates only on the issuing side of the transaction process, and relays information between the card network, issuing bank and settlement parties, including card issuance data, and details on the verification and authorisation of card payments.

It’s important to understand that when talking about payment processing, there is also another type of processor. On the other side of the transaction process is the relationship between the merchant and the acquiring bank.

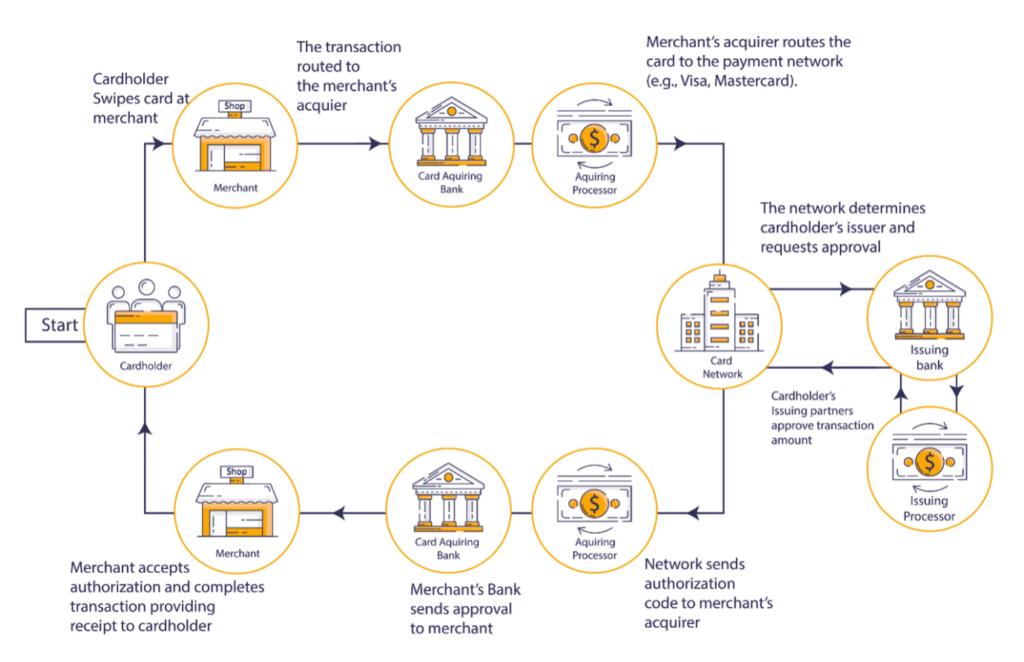

The below diagram will help you understand the movement of information within a transaction – where the acquiring processor handles the merchant and acquirer part of the transaction, and where the issuer processor handles the customer and issuing aspect of the transaction.

When selecting an issuer processor, make sure you evaluate their service carefully and understand how they will support your business today and in the future.

Checking the reliability and stability of any processor you are considering is always a good idea, as it will impact your user experience if there are regular outages.

It’s also vital to ensure any processor you are accessing meets PCI-DSS compliance and security standards, as well as having strong transaction-processing capabilities.

At Carta Worldwide, we pride ourselves in offering a fully configurable platform with the highest level of transaction processing security and reliability.

If you’re unsure of which issuer processing partner is right for you, head to our blog to discover the five things to consider when selecting an issuer processor.

Card Schemes

Card schemes are payment networks linked to cards, debit and/or credit. The most well-known include Visa, Mastercard, China Union Pay, Amex, and Discover. Banks, issuers, acquirers, or other financial institutions become a member of one or more of these schemes so they can offer those types of transactions.

Their main role is to manage payment transactions, including operations and clearing.

The chosen card scheme transfers the card transaction information from the acquiring bank to the issuing bank, then back to the acquirer to confirm the payment.

Card schemes are fundamental in allowing your customers to make purchases and other transactions. Some card schemes vary in what they will permit you to do with your card programme, and some may hold greater appeal for your cardholders than others.

You should consider which card scheme is right for your card programme and the needs of your customers by talking to your partners about the long-term goals of your product. With years of experience working with the schemes, your partners will be best placed to guide you to make the best decision for your business.

FX Provider

A foreign exchange (FX) provider is a financial service business that enables you to buy and sell foreign currencies as part of your card programme.

Traditionally, an FX provider would buy and sell currencies on your behalf, but today many providers offer trading platforms for you to trade currencies yourself.

When considering which foreign exchange broker to partner with, ensure that they are Financial Conduct Authority (FCA) authorised and have no hidden fees.

Card Manufacturer

Card manufacturers are businesses that design and make your company’s physical payment card.

Choose a card manufacturer that enables you to differentiate your card programme, elevate your brand, and secure customers.

Although your card has a practical role in your consumers’ day-to-day transactions, a creative and engaging design plays a huge role in the customer appeal of your programme.

Research the trends in card design and make sure your card manufacturer can accommodate them. Perhaps you want coloured edges, recycled materials, or even a metal card? These factors can seriously affect your customer acquisition and retention levels whilst boosting transaction usage.

Issuing Bank

Issuing banks, sometimes called issuers, are banks or regulated financial institutions that play a major role in facilitating the issuance of debit or credit cards to your customers. They are members of a card network, like Visa or Mastercard.

The issuing bank is responsible for authorising the transaction to the schemes. This involves making sure the consumer has the funds or credit available to make the purchase and verification of account details. Then they will also transfer the funds to the acquiring bank, in a process known as settlement.

Issuing banks are vital for the entire payment’s ecosystem to function, and work directly with issuer processors.

BIN Sponsor

Banking identification number (BIN) sponsors are payment solution providers, sometimes your issuer, that work by issuing BIN ranges so companies can offer payments solutions to their customers. Previously, only banks and direct members of the card schemes were able to generate BIN numbers for their own use.

Using a BIN sponsor is the fastest way to gain access to major card schemes, such as Visa or Mastercard. It is an alternative to joining the card scheme directly, which involves huge costs and time. Using a BIN sponsor is therefore the quickest way to get your card-based financial product to market.

3DS Provider

3-D Secure is a protocol designed to add an additional security layer to online credit and debit card transactions. It enhances security measures for both shoppers and merchants.

When 3-D Secure has been activated, consumers are asked to validate every transaction with a PIN code.

The ‘three’ elements that are cross-checked as part of the validation process using the protocol are the merchant/acquirer domain, the issuer domain, and the 3DS infrastructure platform.

A 3DS provider is not mandatory in all countries but is highly encouraged by card schemes.

Who are the other providers entering the ecosystem?

With the payments industry being a fast-paced and ever-evolving industry, we are starting to see new industry players entering the ecosystem.

Multi-Currency Providers

A multi-currency provider allows you to accept and make payments through a secure online portal.

It provides businesses and other users with currency flexibility for global customers. This gives them the option to make payments in either their home currency or common global currencies, such as USD, EUR, and GBP.

Multi-currency providers act as an international payment gateway, making it easier for businesses to accept payments from international customers and widen their customer base.

Open Banking Providers

Open banking providers are third parties that sit between customers and their banks. They offer services that enable customers to tailor their financial data efficiently using APIs (application programming interfaces) as a bridge between the two systems.

There are two types of open banking providers:

- Account information service provider (AISP): This type of provider aggregates financial data from banking institutions.

- Payment initiation service provider (PISP): A PISP initiates payments without log-in details or using a card.

Every open banking service requires full consent from the end user before data can be accessed or managed by the provider.

By utilising open banking services, businesses and consumers can take greater control over their data and access more sophisticated financial services.

Cryptocurrency Players

Cryptocurrency players may supply digital assets that can be bought, sold, traded, or used as a payment method. Cryptocurrencies operate outside the traditional financial processes and authorities, such as banks.

It is important to consider cryptocurrencies as key players in the payments ecosystem as they can be used as a payment mechanism. An individual can make a payment to another in a cryptocurrency, which is recorded in a blockchain.

Cryptocurrencies are often positioned as an alternative solution to traditional payment systems due to their potential for low transaction costs, high scalability, and decentralised finance.

Data Players

Financial institutions across the globe are facing data quality issues. Reports suggest that 33% of customer data in financial institutions is inaccurate in some way, and that’s why data providers are increasingly important service providers.

Data providers enable businesses to get more value out of their data.

They do this by cleaning, filtering, and structuring data, as well as gaining consent from the data owner through GDPR-compliant opt-in requests. They also analyse the data before it can give value to businesses.

Why is it important for fintechs to understand the ecosystem?

Fintechs and other financial institutions need to understand the card-issuing ecosystem in its entirety as card programmes will need a bespoke mix of these services to go live.

The payments industry is fast-paced and full of new, emerging technologies and service providers. It can be very confusing with each one professing to offer the latest technologies and capabilities. It’s important that fintechs are knowledgeable about how to evaluate each payments services and what they provide when preparing for launch.

Choosing the right partners will allow you to scale and innovate your product or service, enabling you to deliver better functionality that will keep your offering ahead of the curve.

Conclusion

While traditional card issuers, such as legacy banks, still have the licenses to operate, payments innovators can now access the services to compete with them from within the card-issuing ecosystem. These new entrants are finding that modern issuers can offer a more immediate and digital experience that will appeal to today’s consumers and B2B buyers.

Make sure you choose the right provider for your business.

Carta Worldwide is a modern issuer processing platform that enables innovators around the world to develop payment products. If we sound like the issuer processor for you, get in touch.

Fresh insights,

straight to your inbox

Sign up to the Carta Worldwide newsletter

to get the latest insights and news