Payments Pulse 2023:

Why payment providers need to be purpose-driven

Thank you for requesting access to Carta Worldwide’s 2023 Payments Pulse Report.

Payments Pulse Findings

We live in a world of growing purpose. Whether it is the fight against climate change or the fight for equal rights, people across the globe are demanding change, and for that change to be purposeful in its intent and outcomes. We often think of companies or individuals being purpose-driven. But what about payments?

Now as the world contends with never-before-seen social and economic challenges, prompting consumers to take another look at their finances and the way they pay, are payments still aligned with what consumers want? Are payments still answering the call for purpose?

In this 1,000-person survey of consumers across the UK, commissioned by Carta Worldwide, we explore how consumers are feeling about their payments experiences during the economic downturn and how payments providers should respond. The report analyses consumers’ financial relationships, and their financial goals for 2023, and uncovers what payments providers can offer to help consumers better manage their money.

The research reveals that the shockwaves of the cost of living crisis is ushering significant changes in consumer payments habits. Consumers are returning to trusted methods of payment that help them to manage their emerging needs centred around financial goals, savings and security. The research clearly shows that there is an emerging demand for purposeful payments. With many providers struggling to meet these demands, those that focus on fusing innovation with real purpose will be in pole position.

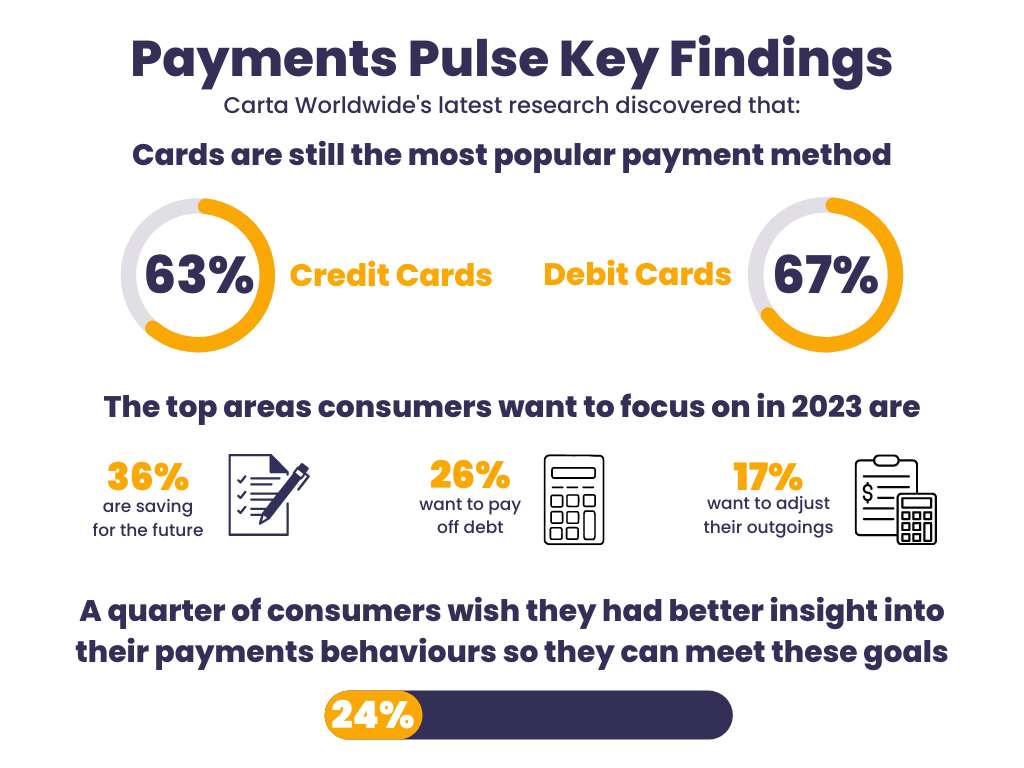

Key findings:

- Cards are still the most popular payment method. Almost all (95%) of consumers said they used either credit (65%) or debit cards (30%).

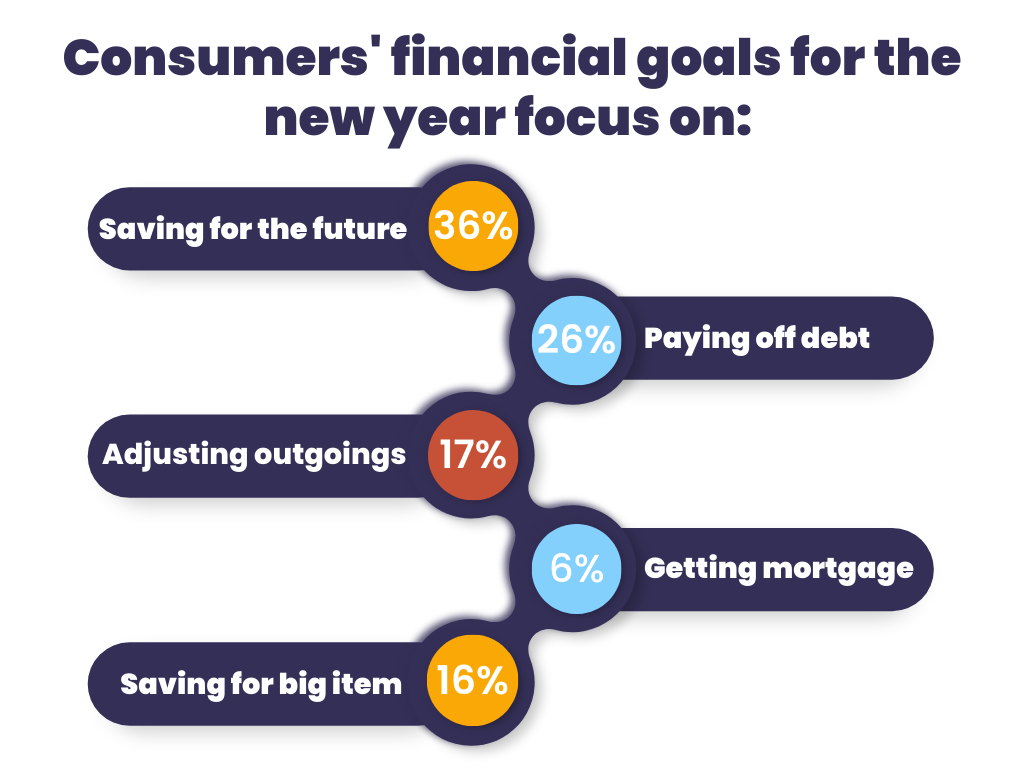

- Consumers’ financial goals for the new year focus on saving for their future (36%), paying off debt (26%), and adjusting their outgoings (17%) because they can no longer afford their current lifestyle.

- A quarter (24%) of consumers wish they had better insight into their payments behaviours so they can meet these goals.

New year’s resolutions

UK inflation is seeing historic highs, as the prices of fuel and food put pressure on household budgets, and consumers are cutting back on how much they spend and their savings pots. Our research shows that the cost of living is also already having an impact on consumers’ short and long-term financial goals.

Overall, consumers’ financial goals for the new year focus on saving for their future (36%), paying off debt (26%), and adjusting their outgoings (17%) because they can no longer afford their current lifestyle. With a reduction in spending on everyone’s minds, significant goals including securing a mortgage (6%) and saving up for a big purchase (16%) are simply too extravagant for consumers to ponder in the current climate.

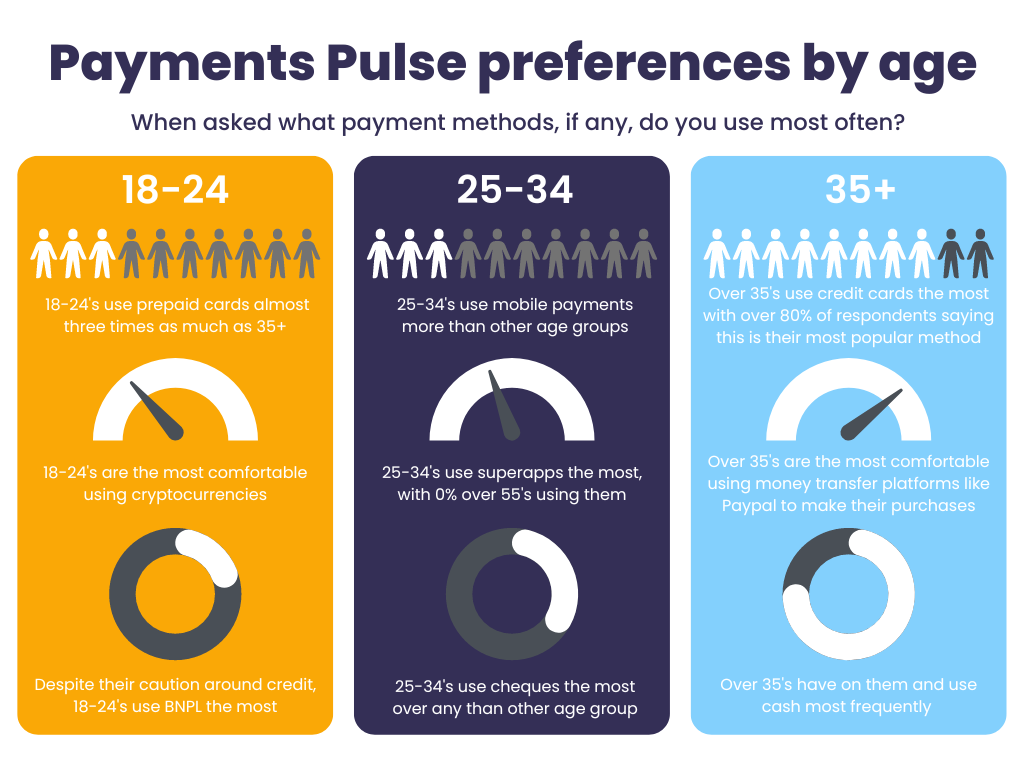

Younger consumers (ages 18-34), however, are more comfortable with risk and have the desire to make their money work harder in the current high-interest rate market. Two in five (40%) said they want to start investing or invest more, over other priorities like paying off debt (19%), growing their savings (23%), or splashing on a big purchase (18%).

Returning to the payments mean

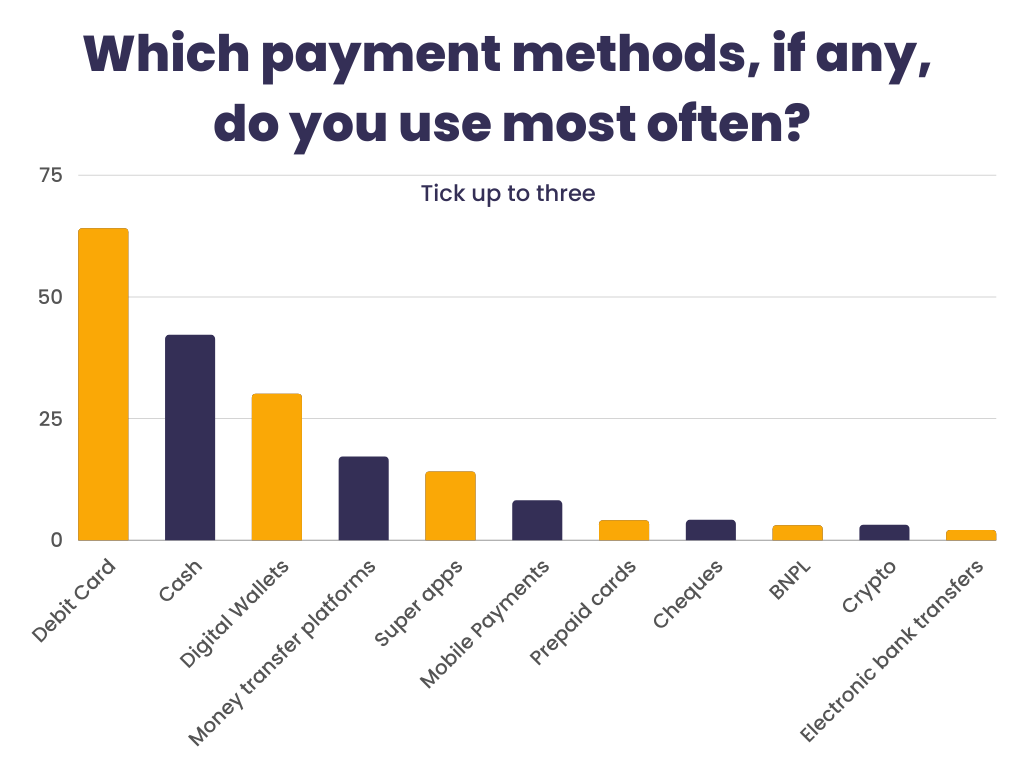

The onset of the pandemic accelerated the adoption of digital payments, as businesses looked for new ways to accept and manage transactions. Contactless, mobile wallets, and embedded payments became the norm as consumers wanted safer, cleaner, ways to pay. But, inflation and the cost of living are causing consumers to peddle back, returning to more trusted forms of payment such as cash and prepaid cards.

Now, cash is making a comeback, with record amounts being withdrawn as consumers increasingly rely on notes and coins to help them manage personal spending. Our research shows that almost half (42%) of consumers now pay with cash on a regular basis, and three-quarters (75%) of consumers plan to change their current payment habits to methods like cash during the downturn.

Yet, cards remain king for now with almost all (95%) of consumers revealing they use either credit (65%) or debit (30%) as their preferred payment method. Figures show that consumers are increasingly taking on debt to make regular payments. Older generations (55+) are more than twice as likely to use credit cards (39%), while younger consumers take a more cautious approach to learning how to use credit. Although lower down on the list of overall payment methods, 18-24-year-olds came out on top (36%), using prepaid cards three times as much as other generations.

What consumers want: Purpose-driven payments

There is a universal desire amongst consumers for better payment experiences. Consumers lean towards wanting better rewards (36%) and more choice in how they pay (22.5%) as their top desired improvements. They see payments as a two-way relationship and feel they ought to be rewarded for the payment option they choose to use regularly.

Younger consumers are more vocal about the need for change – almost all (92%) 18-24 year olds believe that there is room for improvement in their payments experiences. With the current cost of living crisis in mind, a higher proportion of young consumers (ages 18-34) compared to older respondents (ages 35+) indicated they would change habits by analysing their spending more (28% vs 16%) and finding easier ways to pay across borders (28% vs 13%).

Mastercard recently noted how it had seen e-commerce spending reach new heights, accounting for 33% of total retail sales in the UK. E-commerce is inherently international and multi-channelled, reinforcing the necessity to continue evolving consumer payment experiences to meet the consumer where they are.

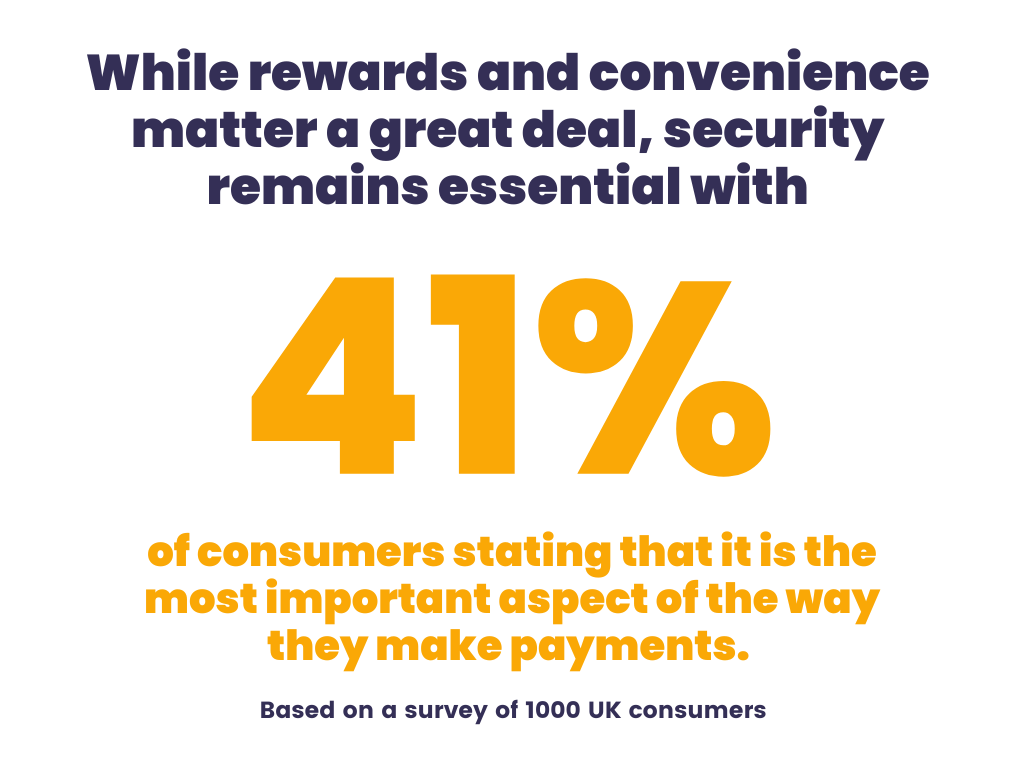

Consumers want payments to be easy, but they also want their data to be secure. While rewards and convenience matter a great deal, security remains essential with two in five (41%) consumers stating that it is the most important aspect of the way they make payments.

There is an opportunity here for payments providers to prove the value, utility, and security of digital payments, to the 42% of consumers who use cash most often.

Evolution not revolution

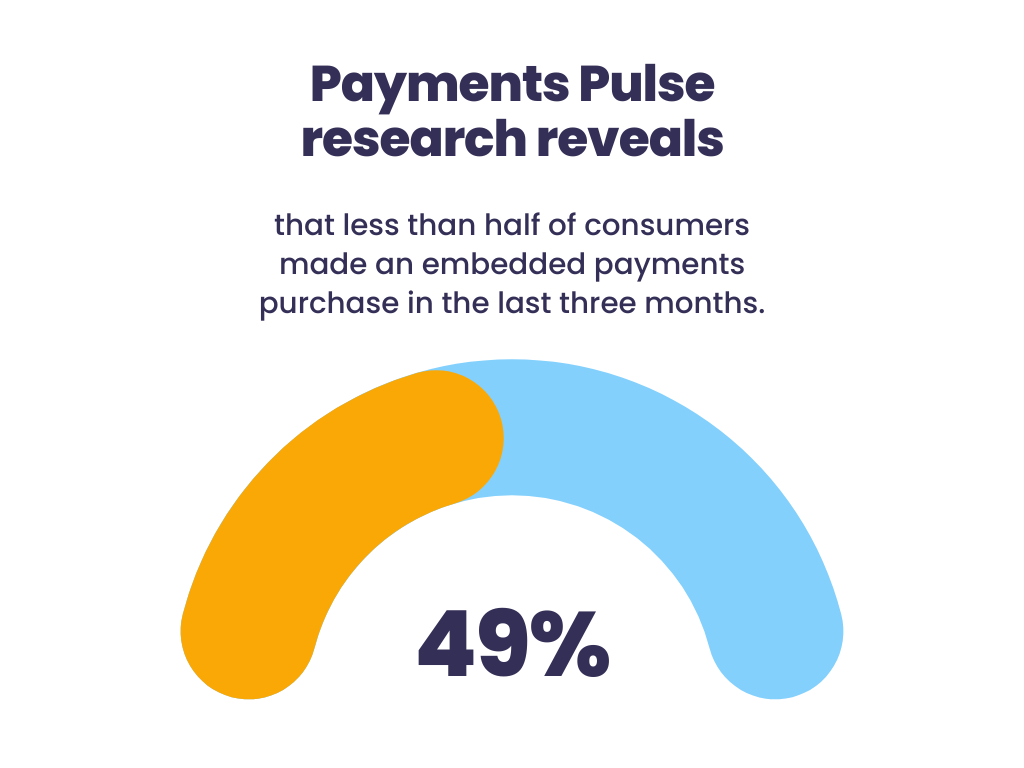

Tough times can lead to profound innovation, but to sustain growth that innovation must happen on top of trusted and more traditional payment methods and align with consumers’ new values and preferences for digital finance. New and disruptive services like “embedded payments” won’t gain traction during the downturn, unless they align payments with purpose.

Despite optimism from the financial community for the growth of embedded finance, our research shows that less than half (49%) of consumers made an embedded payments purchase in the last three months.

Consumers don’t favour one payment method over another. They want to more easily use all methods of payment. What they prefer, however, are options that give them more insight into their payment behaviour so they can meet their financial goals.

While at the same time, more than a third (37%) of consumers believe that payments providers aren’t able to help them tackle the challenges driven by the cost-of-living crisis, and the majority (75%) plan to change the way they pay to help meet their financial values and goals.

Thus, demonstrating a clear opportunity for payments providers to provide payments with purpose, rather than the next big thing.

Conclusion and takeaways

Our research shows that there is an emerging demand for purposeful payments. The payments industry must now focus on fusing trusted and traditional payments methods with real purpose to meet the changing needs of consumers in the wake of the cost of living crisis and recession.

Consumers are eager for help in rethinking their financial habits and by helping consumers get more out of their payments behaviours – from greater rewards, more choices in how to pay, and better spending analysis – payments providers can demonstrate their value during the downturn.

Purpose-driven payments is the name of the game in 2023 and those providers who are able to deliver will be in pole position.

Key takeaways:

- As the cost-of-living crisis bites into everyone’s current lifestyles, consumers are compelled to save more for their future, pay off debt and adjust their outgoings.

- To meet their evolving values and preferences for digital finance, consumers are eager for improved payment experiences that help them analyse their spending habits, offer more rewards, and more choices in how they pay.

- There is an opportunity here for payments providers to prove their worth, but to sustain growth they must demonstrate that they have a real purpose for users.

About Carta Worldwide

Carta Worldwide is a paytech and proven global digital payments pioneer. By bridging the world of legacy payments technologies it allows brands to create pioneering digital payment experiences. Whether a new fintech disruptor or an established business, Carta Worldwide has the technologies, the ecosystem and the expertise to deliver sustainable disruption on a global scale.

Carta Worldwide believes a competitive offering is one that delivers high value by balancing global with local, scale with speed and innovation with resilience. With vast foresight, a proven track record and unrivalled experience, Carta Worldwide works with brands to realise their payments vision.

Carta Worldwide was part of the development team that produced ApplePay and was the first processor in the world to perform an ApplePay transaction. Carta Worldwide’s platform is available worldwide and used in over 40 countries.

Carta Worldwide is backed by Mogo Inc. and is headquartered in London, Toronto and Casablanca.