Europe is now home to some of the most vibrant fintech hubs in the world. The industry has grown rapidly over recent years, spreading much further afield than its origins in the UK – making Europe the global heart of fintech in comparison to the rest of the world.

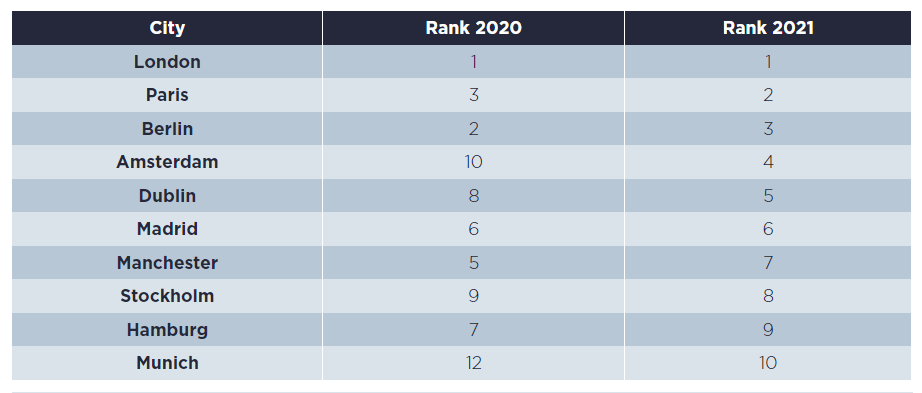

According to Savills’ latest report, London still ranks as the top venture capital investment destination in Europe – followed by Paris, Berlin, Amsterdam, and Dublin.

The UK’s decision to leave the European Union has given other hotspots in Europe a competitive advantage. In recent years, we have seen European capitals, such as Paris, climb their way near to the top. So, will London be knocked off the top of the leaderboard next year?

Despite recent challenges post-Covid, investors are still pouring money into fintech firms across Europe with them now being worth twice as much as any other technology sector on the continent. So, let’s dive into why these European cities are doing so well:

London

Despite leaving the European Union in January 2020, London is still recognised as the leading fintech hotspot in Europe. London continues to rank highly in the top 20 European cities seeing investment in tech development, but why is that?

Network of fintech founders & investors

Full of rich history and resources, London is a unique market for financial services with the industry rapidly advancing since ‘banking’ first emerged in the 17th century.

The traditional banking space has led the way for a long time with providers such as HSBC and Lloyd’s being the most dominant and well-known players…until recently.

We are now in the era of fintechs and neobanks, with modernised business practices, features and functionalities that have got people talking and investors listening. The industry has raised $6.3 billion in 2022 so far for the fintech sector alone, and investment is unlikely to stop.

With so much movement, London now has an extensive network of fintech founders and investors. New and traditional investment companies all want a piece of the pie, and programmes such as the UK Angel Investment Network have been created to enable angel investors to reach out to fintech start-ups directly.

The city is home to 3,018 fintechs. Thanks to fintech unicorns like Starling Bank, Revolut, and Monzo, the UK represents more than 10% of the global fintech market share.

Government fintech reforms

The 2020 Kalifa Review was a highly anticipated report that set out recommendations for how the UK can grow the UK fintech industry and the widespread user adoption of its services.

The review highlighted several opportunities to create highly skilled jobs across the UK, boost trade, and expand the UK’s competitive edge over other leading fintech hotspots.

It remains to be seen how far the report’s findings will be implemented but it appears that the UK is exploring all avenues to retain and grow its fintech reputation since its release.

Diversity & adoption

London remains a testing ground for fintech innovation and the place where new ideas thrive.

The city’s creativity and diversity are also important credentials as a hub for innovation. At 20%, the fintech industry has a marginally higher proportion of Black, Asian, and ethnic minorities than the tech sector as a whole.

Consumers and businesses in London are some of the most open in the world to new tech solutions. An example of this is train users adopting contactless and mobile payments when TFL implemented ‘Tap and Go’ – with over a 360% increase in mobile payments on the underground since the UK launch of Apple Pay.

Paris

Paris has moved up a place since 2021 becoming Europe’s second largest fintech hub and is now a centre of fast-growing fintech firms.

Growth of fintechs & payment solutions

Following President Macron’s long-held vision to become a ‘start-up nation’, a number of Paris-based and founded companies are at the forefront of fintech growth.

Qonto, founded in Paris in 2016, is an all-in-one bank account for SMEs. They received the largest French fintech deal in H1 2022, raising a whopping $552m in Series D funding. Across 2023, the business is set to expand its product offerings and strengthen its market presence across Europe.

Payfit is another business that is helping to grow the fintech industry. Launched in Paris in 2016, Payfit is a payroll and human resources management software. They are now global and transforming companies’ everyday lives by automating their payroll and reducing spreadsheet errors.

French investment in fintech

The increase in investment looks set to continue its upward trajectory.

Based on the first half of 2022, investment in French fintechs is expected to increase by 73% from 2021 to $6.4 billion in 2022.

But it’s not just the fintechs that are doing all the work…

Launched at the beginning of 2022, Resonance is a new €150 million VC fund based in Paris, backed one hundred percent by Otium Capital. Resonance focuses on seed and Series A investments ranging anywhere from €100,000 to €10 million. They plan to invest in the growth and development of fintechs in Paris and across Europe as a whole.

Berlin

Closely followed by Paris, is Berlin.

Fastest growing fintech hotspot

With more than four hundred fintech companies, Berlin is facilitating transactions across the globe.

N26 was founded and is now headquartered in Berlin, Germany. Now labelled as the ‘best bank in the world’, the neobank is one of the most highly valued fintechs worldwide and is constantly evolving its offering to remain top of the wallet.

Also launched in Berlin in 2016, Billie provides businesses with financial point-of-sale tools for extending credit terms to B2B buyers, alongside an invoice collection kit. In a recent $100 million equity injection, giving Billie a $640 million valuation, the company partnered with Klarna, so their customers could access invoicing services via their Klarna integration.

Berlin has fostered some of the most influential and most talked about fintechs today, and has more than Munich, Frankfurt, and Hamburg combined.

A hub for start-ups

With around 22% of all German start-ups launching in Berlin, the capital city is becoming a popular place for start-ups to establish themselves in – both in Germany and across Europe.

The city actively supports start-ups in their early stages and growth periods, making the city a hub for innovation and business development.

The Berlin Start-up Scholarship is a key institution that is helping drive this growth. They provide financial support to founders of technology-based start-up prototypes to help them enter the market. The project is set to support more than 1,500 individuals between 2014 and 2023.

Amsterdam

Back in 2021, Amsterdam jumped a huge ten places to fourth place in the list of Europe’s fintech hotspots.

The leading city in green finance

The Global Green Finance Index has recently ranked Amsterdam as the world’s leading city for green finance.

The ranking consolidates Amsterdam’s reputation as an impact-driven and forward-thinking financial centre. It is home to countless fintech companies that are focused on circularity and sustainability.

Amsterdam is home to many eco-friendly fintechs, bunq being one of them. Described as the ‘bank of the free’, bunq is a bank that calls for a sustainable future by offsetting customers carbon footprint as they spend and prioritising green initiatives such as lowering greenhouse gas emissions.

World-class financial infrastructure & open regulatory system

Amsterdam has a renowned financial infrastructure and regulatory system implemented.

Although the Dutch financial regulator is strict, they are also open-minded and well-respected in Europe. So, although it may not necessarily be easier to get regulatory approval in Amsterdam, if you are successful, you can rest assured that you will be well-respected and taken seriously throughout Europe.

The Netherlands sees their regulators as an important facilitators of innovation and is the reason new fintechs are regularly forming there.

The fast-paced city is also conveniently located just a stone’s throw away from other European financial hotspots, such as London and Berlin, allowing for cross-country partnerships.

Dublin

The fifth most attractive European city for fintech is the capital and largest city of Ireland, Dublin – and its reputation is rapidly expanding.

Lower cost of living & corporate tax environment

Dublin is known for its lower cost of living. For example, more affordable properties have helped to lure numerous fintechs to set up a base in the city.

Ireland has also used tax incentives as a powerful tool to attract financial investment. The key to its fintech success is its low rate of corporation tax on trading profits.

Well-developed fintech ecosystem

Over the years, Dublin has built a solid financial ecosystem.

The Government and dedicated industry bodies are backing programmes that are encouraging Ireland to become a hotbed in fintech innovation.

With the IFS2020 strategy now in place, there is huge support for the fintech industry and focus is being placed on policies that will encourage growth in this area. Big names in the industry are marking their territory in the Dublin fintech ecosystem.

The payments conglomerate, Mastercard, has recently unveiled its European Tech Hub, in the heart of the city, which will serve as an innovation engine for digital commerce.

What’s next?

Governments and regulators are working hard to make their countries attractive for fintechs in the hope they will help drive employment and growth in the national economies.

Barriers to entry have reduced as technology has flourished, forcing traditional financial companies to change or be left behind in the competitive European landscape.

For this reason, fintech hubs are constantly changing, just like the industry itself, in order to help their homegrown businesses gain in strength and relevance for customers and the economy.

It will be fascinating to see which fintech hotspots climb the rankings by the end of 2023 after what is set to be a turbulent year for the industry. How will these hotspots support their innovators? And what will the differentiating factors attracting a new breed of Fintech companies to their cities? We look forward to finding out.

Fresh insights,

straight to your inbox

Sign up to the Carta Worldwide newsletter

to get the latest insights and news